A brief discussion on some of the most important use cases of energy storage today, particularly with respect to modern-day liberalised markets, as well as how such systems can be deployed effectively and profitably in such circumstances and why they should be.

Foreword

This article will provide an overview of energy storage* systems in modern, liberalised electricity markets; focusing specifically on Europe (many of the use cases explained can apply to energy storage in general, however).

The main focus will be on the macro-economic application of storage, followed by more specific use cases that are supported by real examples, providing an overview and awareness of why and how these systems can be effectively deployed (i.e., use cases), both in terms of their environmental and economic potential.

The main use cases discussed are: (i) colocation with renewable technologies (ii) energy storage systems’ trading capabilities, (iii) electricity price and carbon reduction through flexibility, and (iv) ancillary services.

While this is not an exhaustive list (e.g. peak shaving or behind the metre applications were not mentioned), the use cases selected are considered some of the most important in the current market. It is intended that after reading this article, the reader will have gained a situational awareness of energy storage systems and their place within modern electricity markets. In addition, the markets discussed are liberalised ones, as opposed to centralised, which was the case in most countries across Europe**.

*Energy storage is referred to in its technological entirety, from lithium ion to flywheels, and is treated collectively in its deployment in response to certain problems and pressures, namely climate change, incoming weather-based renewables and struggling electrical grids

**For information about centralised and liberalised markets (de-centralised), have a look at our article on the topic “Centralisation to Liberalisation of European Electricity Markets”.

Colocation, Curtailment, Congestion

The Achilles heel of weather based renewable technologies, such as solar and wind, is the intermittent nature of their supply. By virtue of their inherent dependence on a non-controllable variable (the weather), weather-based renewables can, at times, produce too much energy (leading to either congestion or grid curtailment), and at times produce too little (Figure 1). This leads to inevitable challenges in terms of forecasting supply and demand, difficulty in grid side management and an overall blunted penetration into the electricity market.

Curtailment, for example, occurs when load demand exceeds grid capacity for transmission, causing the grid to become temporarily “full”. In other words, energy is rejected or turned down by the grid as it cannot physically handle any more. To get an idea of the current scale of curtailment, in Germany approximately 3,060 GWh of wind energy was curtailed in 2015, and 1,277 in the UK (windeurope.org, 2016). With wind and solar expected to grow substantially in the coming decades, this problem is expected to exacerbate significantly. For renewables, curtailment often occurs during very favourable weather conditions. Many renewable assets produce a lot of power at once, often connected to the same section of the grid. The resulting congestion from this surge forces curtailment of the renewable assets, which means any excess power produced above the transmission capacity is wasted, or “curtailed”.

Coupling a renewable asset with an energy storage system on-site via colocation can solve the curtailment problem. Curtailed power can be directly fed into an energy storage system, resulting in less power and revenue waste. This power is then available when required, outside of congestion times, and can be supplied to the grid when needed. The asset operator benefits from a larger total amount of usable energy as well as an increased degree of flexibility as to where and when they can sell it.

Congestion also occurs during times of peak demand, renewable energy and weather conditions aside. Sometimes the grid is simply not equipped to deal with the required demand loads, and its limited capacity in some areas becomes a bottleneck. The Netherlands in particular is struggling with the impacts of congestion. In 2023, it affected over 280,000 Dutch homes and is expected to increase to over 1.5 million by 2030, an increase of more than 440% (Aurora, 2024). It has also led to much longer grid connection waiting times, in turn delaying planned renewables, which threaten long-term climate goals in the Netherlands (Aurora, 2024). Such is the size and scale of the problem that the Dutch National Grid Congestion Action Program has been launched which aims to speed up planning and infrastructure improvements. In addition, the main Dutch Transmission Systems Operator (TSO), TenneT, has invested EUR 7.7 billion in “grid investments coping with grid congestion and bottlenecks” (TenneT, 2023).

One such solution to grid congestion is energy storage. As a standalone system, energy storage systems can be strategically located near congestion points and high demand areas, pre-empting congestion issues by having a localised supply of energy ready and waiting, avoiding congested power lines altogether. This solution can allow struggling grids to handle congestion until grid infrastructure catches up, as well as future proofing particularly susceptible areas of the grid against further congestion.

Therefore, one of the most important use cases of energy storage is its ability to assist in the integration of weather-based renewables. Energy storage can solve each of the most challenging aspects of weather mased renewables (i.e., curtailment and congestion), as a standalone system, or even more effectively through on-site colocation with a renewable asset, and is therefore essential in allowing increases in renewable deployment (Dominik Heide, 2011). In addition to solving these problems on a grid scale, energy storage can serve as a performance enhancer on the level of the individual operator, increasing their revenue generation and market penetration.

Figure 1: Typical performance of an energy storage system collocated with a wind farm. Shown is the asset’s production profile with a simplified contracted load profile (consumer, black line) and a collocated energy storage system. Over production can be remedied by storage charging, avoiding unnecessary selling/curtailment, whilst under production by storage discharging, ensuring a more adequate provision of supply. The brown area refers to sold electricity, and light blue to curtailment, both a function of over production with respect to the contracted load profile. The capping of the energy storage charging is due to storage system capacity, hence the periods where supply was not met, or energy was curtailed. Sometimes electricity is sold instead of stored, depending on electricity prices. Source: Catalyst optimisation software, phelas Gmbh.

Economic shielding and carbon reduction

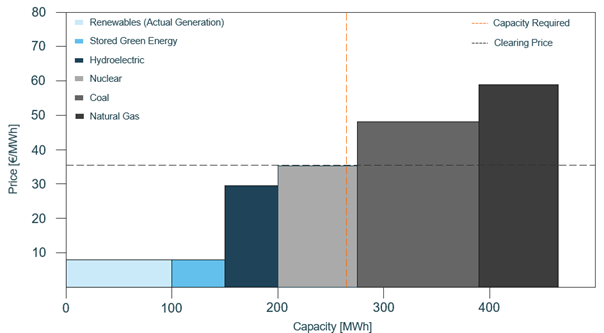

Aside from assisting in renewable asset integration into grids, energy storage can also greatly increase renewable energy penetration into the market, as well help lower electricity costs and our reliance on non-renewable, carbon-based production of energy. The flexibility awarded by energy storage can result in increased availability of both the total amount of green energy and the period over which it is available. Overall, this means cheaper electricity prices and a reduction in carbon emissions. With an increased utilisation of green energy as a result of an increased uptake in the use of energy storage systems, markets can be shielded from including expensive, carbon heavy fossil fuel plants in their economic models. The wholesale markets use the merit order model in determining what assets are to be included in supplying consumers in each bidding block, and at what price (Figure 2). In the merit order model, producers are stacked from the lowest to the highest marginal cost of production €/MWh. The artificial lengthening of renewables via energy storage can increase the likelihood that fossil plants are excluded in any particular auction block. This has two effects: firstly, eliminating carbon borne energy from an auction period, (or at least increasing this probability) and secondly, lowering the final cost of electricity for consumers. Therefore, energy storage can clearly enable an economically viable transition from fossil fuels to renewables in the future, both by making it physically possible to exclude their use and by effecting the economics of electricity production.

Figure 2: Shown is a highly simplified merit order model. In the merit order model, producers are stacked from the lowest to the highest marginal cost of production* in €/MWh. Renewable energy sources, which have a marginal cost close to zero, typically come first, followed by nuclear, coal, gas, and so on. The required capacity for a bidding block (e.g. 15 mins or 1 hour in DA and ID) is determined in MWh and shown as the vertical red line. This line cuts through the last energy producer required to fulfil expected demand. The asset’s marginal cost of production is then used to determine the “clearing price” of the bidding block. All energy assets within the required capacity area (i.e.to the left of the red line) are then paid this price for their energy. This clearing price greatly effects the price of electricity for the end user. In this example, if the stored (light green) energy were omitted, the coal fired asset would be included and determine the clearing price, causing a large spike in the cost of energy to the consumer, as well as the need to burn fossil fuels to meet demand. Source: Author

Want to know more?

Get the latest publication and read more about how to master energy storage for your project.

Wholesale market optimisation

Environmental and performance impacts aside, the flexibility provided by an energy storage unit can itself be used to trade across multiple markets and bidding periods. An energy storage system can interact with these markets in a standalone fashion, or augment an existing renewable asset’s trading, with its flexibility via colocation. Multiple market participation is essential for making energy storage systems feasible if standalone (Staffell, 2023), and a valuable addition to a renewable producer if collocated.

The bulk of traded electricity occurs on the wholesale markets. Large volumes are traded bilaterally, but account for less total energy exchange. Two main submarkets within the wholesale markets are: The day ahead (DA) and intraday (ID) markets*, both of which are suitable for energy systems.

Standard electricity producers do not have the technical capability to charge and discharge to and from the grid, as provided by a storage system, and require coupling with one to fully utilise their production in terms of revenue. A producer can have the most advanced market forecasts and strategies available, but their effectiveness is dampened considerably if their output is dictated by weather and they lack the ability to buy or sell flexibly.

Energy storage systems can operate optimally within and across markets. Such abilities can be afforded to existing asset operators. The result in both scenarios is a flexible combination of lucrative revenue streams, which can interact intelligently with the markets, significantly increasing the economic viability of renewables and energy storage systems.

*These markets differ by the granularity of bidding blocks in an auction period, and when they occur before actual delivery of power. In Europe, the DA is typically broken into hourly blocks a day before actual power delivery, whereas ID (see Fig. 3) consists of 15-minute blocks on the day of delivery. This can differ slightly between countries, but not by much.

Figure 3: A typical pricing pattern for electricity prices over a 24-hr period on the ID market. Prices often vary by over 20 €/MW from one bidding block to the next, representing ample opportunity for energy storage. Source: Nextkraftwerke.

Energy storage as an ancillary service

Ancillary services focus on grid stability and function, as opposed to the wholesale markets mentioned earlier which facilitate buying and selling large quantities of energy. These services can include frequency regulation (real or near real-time supply/demand balancing), voltage regulation and other services such as black start functionality (restarting parts of the grid post-blackout) (Deutsche Energie-Agentur (dena, 2022).

The number of ancillary service assets required to service the European grid is expected to increase as more renewables are installed. Fossil fuel plants provide most ancillary services today (Deutsche Energie-Agentur (dena, 2022). This is due to the fast, flexible power supply they can provide. Energy storage systems have similar capabilities and can replace these plants in providing such services*. Such provisions can often secure profitable contracts and bids, adding to the revenue streams an asset operator can access. Storage systems can provide these by themselves as well as enhance the ability of existing producers to do so, again through their flexibility capabilities.

These markets sell capacity, as opposed to just power, with the guarantee that it is made available for a specific purpose (some form of ancillary service). This is highly suitable for storage. In some cases, there is also payment for actual activated power, i.e., a portion or all the available capacity is activated, and the operator receives remuneration. Revenue is received for the reserved capacity, whether it is activated or not. In essence, you are paid for the promise.

*Energy storage can also replace traditional fossil based “peaker plants” in this regard, further displacing fossil fuels in our grids.

Conclusion

The use cases presented highlight the ability of energy storage systems to stabilise grids and enable renewable integration, as well as the economic viability afforded by the deployment of such systems. The liberalisation of the modern electricity landscape has made available abundant opportunities for many market players in a previously centralised space. This has led to complications, but also very effective solutions in dealing with environmental and economic pressures, one of which is energy storage.

Energy storage can ease the integration of badly needed large-scale deployments of renewables through curtailment reduction, congestion management and an increase in profitability though enhanced trading. Altogether, the risk involved in deploying such assets is reduced through enhanced operation, higher predictability, and more intelligent market interaction, all of which is provided using energy storage.

In addition, energy storage systems can provide much needed stability to struggling grids when it comes to congestion management and the provision of ancillary services.

The fact that such systems are profitable as well as environmentally effective cannot be understated, especially considering the size, scale and cost involved in decarbonising economies and dealing with climate change. However, no matter how effective or green a solution is, if it doesn’t make money, it cannot realistically be developed and deployed at the scales required to make an impact in each of the areas mentioned. With that considered, each use case summarised here, demonstrates the physical and financial reality and viability of such system deployments.

Key takeaways

- Colocation of renewables with energy storage can mitigate issues like congestion and curtailment by storing excess power and releasing it during shortages or times of higher prices, enhancing the reliability, profitability and penetration of renewables whilst helping them integrate into grids.

- The flexibility of energy storage can reduce electricity costs and carbon emissions by allowing increased use of renewable energy, thereby helping avoid the inclusion of expensive, carbon-intensive fossil fuel plants in the energy mix and price setting mechanisms.

- By participating in ancillary services, energy storage systems offer grid stability and support functions that are increasingly necessary as the share of renewable energy in the grid grows.

Discover more Energy Insights

Get the latest publication and read more about how to master energy storage for your project.