Get clear answers about the best solution for your asset.

The long term business case

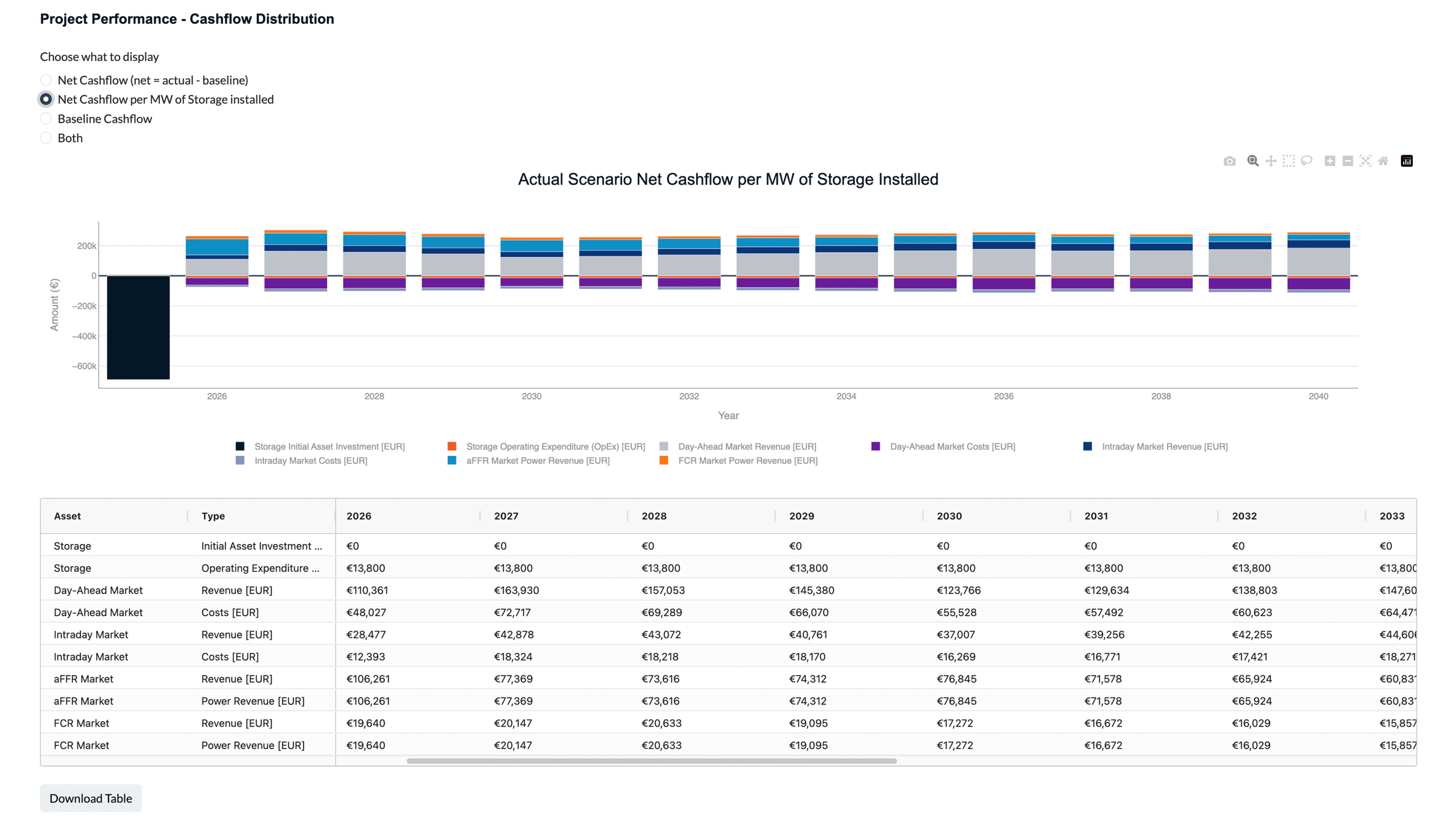

Your assets are designed for 30 years of technical lifetime, why rely on short term forecasts and historical revenues? Your economic lifetime should also be 30 years and that’s what you should optimize for: the long term business case.

The optimal technology setup

Integrated into a complex setup of generation and grid regulation, different storage sizes perform different. Correctly size your asset depending on this environment and receive stable returns.

Embrace financial stability (and profitability)

Your project shall shine in difficult market situations, embracing safety and stability? Catalyst can tell you, which remuneration scheme or market concepts serves your purpose best.

Be confident; adapt to change.

Requirements from investors and grid operators can change; new battery technologies and financing condition can significantly alter financial metrics. Investigate the impact within minutes and make informed decisions ahead of your competition.

Make strategic decisions for your portfolio.

Analyse retro-fitting potentials

Uncover hidden potentials in your portfolio and add precisely designed BESS to drive revenues.

Model future grid scenarios

Grid curtailments are an upcoming risk, you can understand and mitigate.

Future-Proof against the stranded asset

Standalone generation assets may face declining profitability and long-term value. Integrating co-located storage offers a strategic hedge against that risk.

Explore new business models

New business models such as cap and floor PPAs or other participations can be evaluated with Catalyst.